submission gst-03 return for final taxable period

The date of application is earlier of the date of aadhaar authentication or fifteen days from the submission of the application in Part B of Form GST REG-01. For the rest of the applicants physical verification of place of business will be carried out including documnet verification as the case may be with permission.

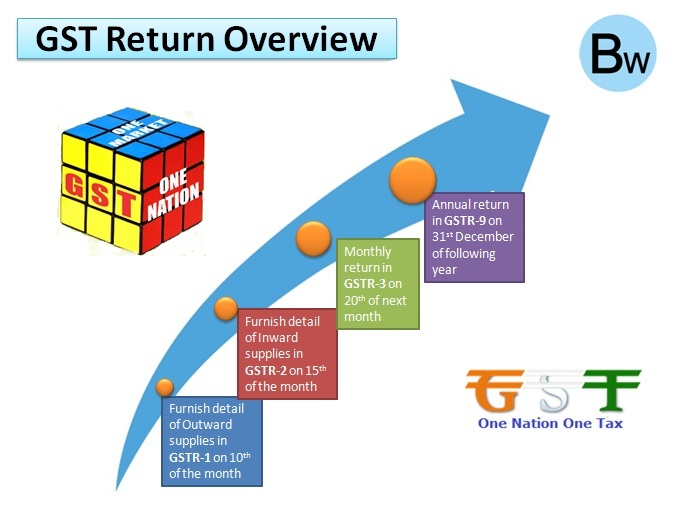

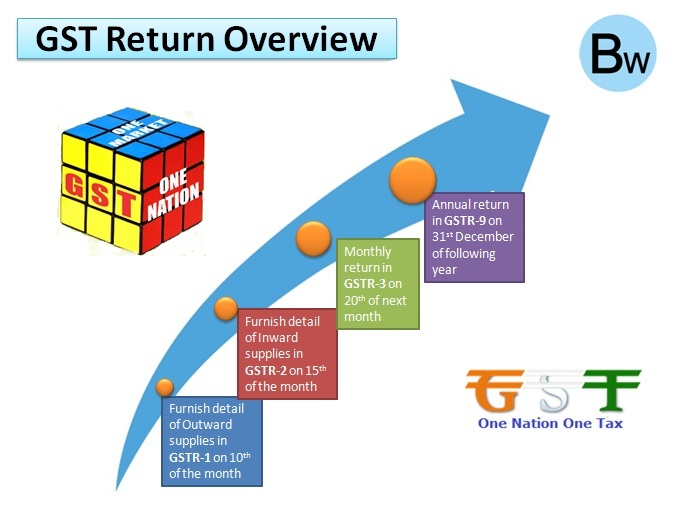

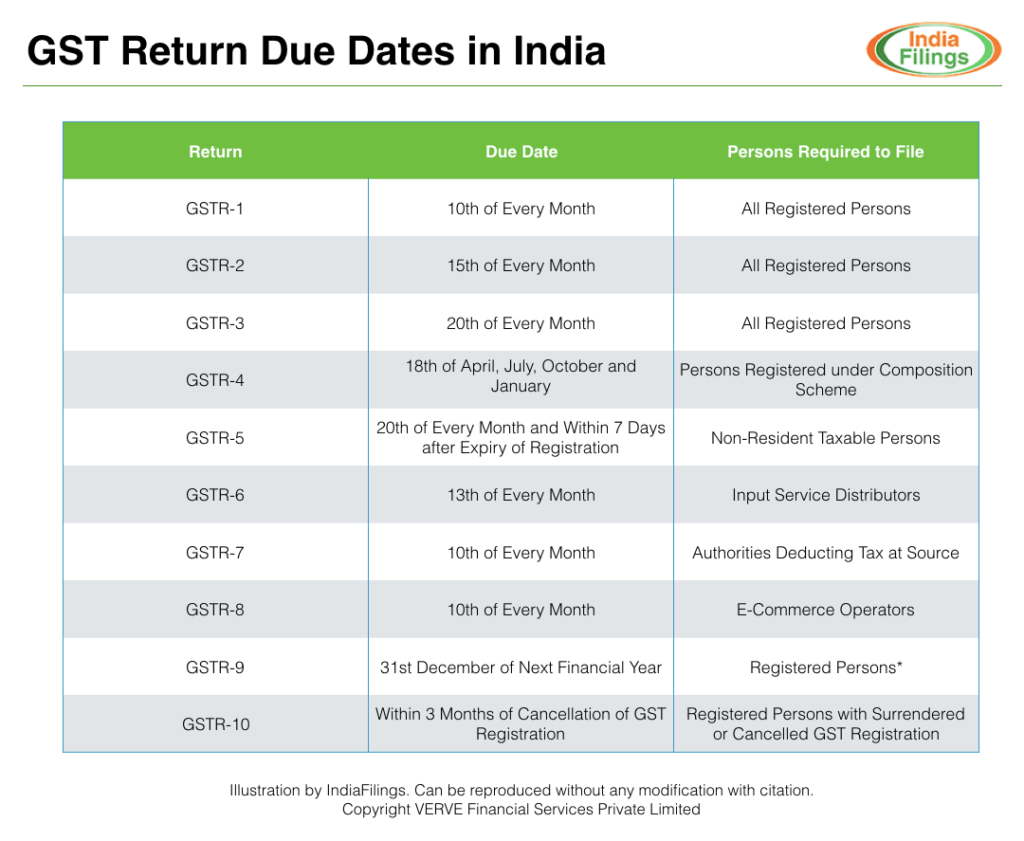

Gst Return Types Of Forms In Gst Returns And Their Due Date

Updating of PANTAN of HPSEB in name of HPSEB Ltd.

. Quarterly review note on the internal audit of consumers accounts and physical verification of stores for the quarter ending 1217. Guidelines regarding GST return submission. Cases of deemed approval have also been.

Minutes of the meeting on implementation of ERP SAP clearance of old.

How To File Your Monthly Gst Returns Money Boat

Gst Return Filing Chennai Online Gst Filing Consultants Chennai

Gstr 3a Notice For Not Filing Gst Return Indiafilings

How To File Your Monthly Gst Returns Money Boat

Gst Submission Of Final Gst Return Estream Software

Gst Returns Types Forms Due Dates Penalties Certicom

What Are Gst Returns Types Eligibility And Filing Dates Legalraasta

What Is Gst Return Who Should File And Types Accoxi

Gst Return Filling Mantra Consultancy

Cbic Has Enabled New Facilities W R T Filing Of Various Gst Return On Gst Portal A2z Taxcorp Llp

Updates In Gst Return Due Dates Gstr 1 Gstr 3b Filling Dates

E Way Bill Guide To Preventing And Dealing With Seizure Of Goods

What Is Gstr 9 All You Need To Know About Annual Filing Of Gst Return

Complete Guide To File Gst Return Online For Taxpayers Sag Infotech

A Complete Guide On Gst Returns On Exports Refund Process

Gst Return File Online Process Gst Return Helpline Gst Return Filing Consultants Gst Suvidha Centers

16 Types Of Gst Return Your Business Should Be Aware Of Corpbiz

All About Gst Return Filing Due Date Late Fee And Penalty Alankit In Blog

Gst Return Forms Different Types Of Gst Returns In India Ebizfiling

No comments for "submission gst-03 return for final taxable period"

Post a Comment